Strategic Binary Trade Types:

These types of trade form the ‘core’ of all our fixed odds trading strategies including the ones detailed in this guide. The strategic trade types are as follows:

1. Rise/Fall

2. Higher/Lower

3. Touch/No Touch

4. In/Out

NOTE: Rise/Fall trades are no different to Higher/Lower trades (if you specify “than the current spot” as 0 (zero) when placing a Higher/Lower trade). Additionally, for Rise/Fall trades you can specify a timeframe less than 5 minutes, but we see no reason why anyone

would want to do this, as part of a well thought out trading strategy. So for Rise/Fall functionality see the Higher/Lower trade type definition

Higher/Lower

Concept: This is a bet that an instrument will close above/below a specified price at the end of a specified period of time. “Higher” or “Lower” is specified when placing the trade. If the market price is above the specified price (for a “Higher” bet type) at the end of the specified period, the bet will be won. If it is below the specified price, then the bet will be lost. “Higher” bet type shown in example above. For a “Lower” bet type, the bet will be won if the market price is below the specified price at the end of the specified period. If it is above the specified price, then the bet will be lost. In both instances, it does not matter what the price does during the specified period. All that is important, is where the price is at the end of the specified period.

Concept: This is a bet that an instrument will close above/below a specified price at the end of a specified period of time. “Higher” or “Lower” is specified when placing the trade. If the market price is above the specified price (for a “Higher” bet type) at the end of the specified period, the bet will be won. If it is below the specified price, then the bet will be lost. “Higher” bet type shown in example above. For a “Lower” bet type, the bet will be won if the market price is below the specified price at the end of the specified period. If it is above the specified price, then the bet will be lost. In both instances, it does not matter what the price does during the specified period. All that is important, is where the price is at the end of the specified period.

Example: The USD/CAD has rallied strongly but you expect the price action to top out in the next few days. You use the “Lower” bet type with a price, of say 100 pips, below the current market price and a duration of 7 days. The market moves down. Provided it is lower than the specified level at the end of the specified period, you win.

Our View: The Higher/Lower bet type can be used when you feel strongly that the market is heading in a particular direction.

Touch/No Touch

Concept: This is a bet that an instrument will touch/not touch a specified price during a specified period of time. “Touch” or “No Touch” is specified when placing the trade. If the market price touches the specified price (for a “Touch” bet typ

e) during the specified period, the bet will be won. If it is does not touch the specified price then the bet will be lost. For a “No Touch” bet type, the bet will be won if the market price does not touch the specified price during the specified period. If it does touch the specified price, then the bet will be lost. “No Touch” bet type shown in example above.

Example: EUR/USD has reached record highs at 1.5000 and you expect its

gains to consolidate in the near term. At its all time high, you place a “No Touch” trade at 1.5200 within the next 5 days. Provided the EUR/USD consolidates, does not move higher and it does not touch this level before expiry, you win.

Our View: We particularly like the Touch and No Touch bet types as they allow us to predict general levels that the market may or may not touch. Depending on our trade setup and fundamental view, we can adjust the levels to our liking for the optimum return or move those levels to reduce our return for a greater safety barrier.

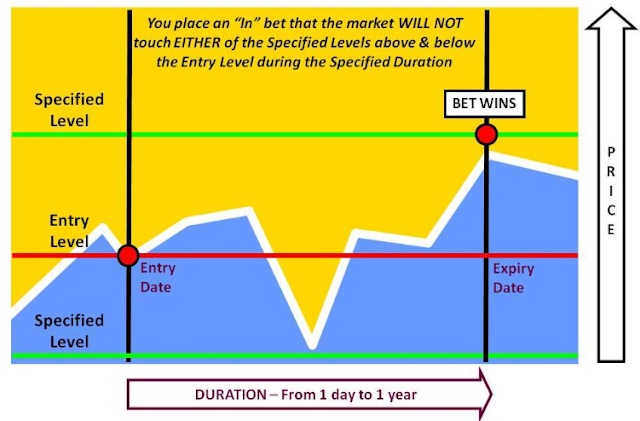

In/Out

Concept: This is a “boundary” bet, where two price levels (a high and a low) are specified. It is a bet that an instrument will either stay within a specific boundary or will breach the boundary. If during the specified period, the market price does not touch either of the specified prices (for an “In” bet type), the bet will be won. If it touches either of the specified prices, then the bet will be lost. For an “Out” bet type, the bet will be won if the market price touches both of the specified

prices during the specified period. If neither of the prices or just one of the prices is touched, then the bet will be lost.

Example: The EUR/GBP pair is at 0.8950 and has been trading in a range for the last two weeks. You expect this to continue in the near future and place an “In” trade, that it will not hit either 0.9150 or 0.8720 over the next 7 days.

Our View: The “In” bet type is ideal for trading during periods when the markets are quiet and/or in consolidation. The “Out” bet type could be used for periods of high volatility, but to date we have not found much practical use for it, preferring to choose a direction and use the “Touch” bet type instead.

No comments:

Post a Comment