Forex Brokers Online Trading

10 Best brokers Online trading Trading strategy Learn about Forex trading Forex e-book Trading software

Sunday, March 19, 2017

5 Binary Options trading Strategies for Beginners

You decide to try your hand at binary options trading. In binary options, you will not be the player, but mostly, an investor who invested the money in a solid project to earn. That is why binary options trading strategies are your main weapon. There is a big set of such strategies, if you want to succeed, you must actively learn and apply the ones that you like and seem promising. Begin training with simple binary options strategies for newbies. It should be recalled that binary options are a bit of a part of the vast and complicated mechanism – the financial market, which is not chaotic and random, but this market operates according to certain laws and regulations.

Diversification Strategy

The result of the option is directly dependent on the general situation in the market and the specific current price for a particular asset. Only by applying certain binary options trading strategy, trader can trade successfully and as a result, earn on his investments. Remember that any strategy, even seemingly win-win, does not work ideally all the time. The loss is possible and you can lose money, but, more importantly, do not lose all at once. Allowing the possibility of episodic subsidence of capital, you should not put all the money into one option. It is very risky and reckless. Ideally, you should have the funds, at least for ten investment. Such a reasonable and prudent attitude towards deposit called funds diversification. Let the idea of diversification has never leaves your mind.

Five Minutes Strategy

This strategy is uncomplicated, would say even an elementary simple, and it is ideal for beginners who have no experience, no serious capital on deposit. It does not guarantee one hundred percent of success, but its probability, according to conservative estimates, is close to eighty percent. During the day, you can use it repeatedly, increasing thus your small capital unless, of course, you are quite reasonable, and good luck will not turn away from you. Five Minutes strategy is based on the fact that many brokers allow you to buy options on their extreme extent – in five minutes before the expiration. All you need is to rummage around the assets in the market and find one that is stable and growing for a long time or, conversely, decreases. Do not forget to trace its maximum value, which, for sure, this time may be a turning point for the trend, and reached a historic high, trend likely will change the motion vector to the opposite.

Appropriate Trend for 5 Minutes Strategy

Martingale

The principle of the Martingale is considered to be less risky and safe when trading binary options. Martingale principle is based on doubling the following amounts, if the previous trade failed. That is, if you lose $100, you have to trade again with an amount of $200. If you lose $200, it is the time just to put $400. You should double your trading amount as long as you win, otherwise all the previous trades to turn very significant loss.

Therefore, to apply the principle of Martingale in its purest form, relying solely on luck, is very risky. You should find the currency pair, with a clear up or down trend of price movement. It is logical to assume that this trend will not change in the near future. You should use this temporary stability. It is more reliable to trade binary options by Martingale principle using binary option indicators. Binary options signals already give you a chance to win, and using the principle of Martingale you will greatly increase it.

15 Minutes Strategy

You should track an asset on 15 minutes timeframe, if we see three or more consecutive candles of the same color, let’s wait for a rollback. We should buy binary option after 2 minutes hoping for rolling back. For example, we see that three white candles closed, new candle opens and it goes in the opposite direction – the price decreases. We wait two minutes to make and fix it rolled back and buy Put binary options with a term of expiration at the close of the current candle i.e. after 13 minutes. Buying an option is still recommended in the case when the bodies of three candles together make up more than 15 points.

Example of Pattern Needed

Triangle

Triangles are different, but they all show the imminent breakthrough price. Some of them – are rising, portend the imminent increase in prices and a break up, but falling triangles, on the contrary, are harbingers of its likely fall. Accordingly, traders have to trade on an increase or decrease of the price when you see that the chart has formed the corresponding figure.

Triangle

In an uptrend, price movement forms the ascending triangle. To see it, trade should visually draw two lines through the points of resistance and support. Resistance line (higher) must be horizontal and support line is located at an angle thereto. It is obvious that in a downtrend, traders have to look for a downward triangle. In descending triangle, support line is horizontal, resistance line disposed at an acute angle to it – on sinking maximum points.

Saturday, March 18, 2017

Binary Option Golden Rules

Binary Option Golden Rules:

we have created a set of ‘Golden Rules’. We suggest that you refer back to these often and let them form the basis of your trading.

1. Define Your Trading Plan:

What are your goals, objectives, desires? How will you achieve these? Are you a high risk, get rich quick type of trader (gambler) or more conservative (and realistic)? Your trading plan will help to set out a template for your trades, the levels and returns that you will set and why you are trading. Refer to your plan often. Your plan should not be so rigid that it restricts any form of flexibility, but it should serve as a reminder of what you set out to achieve. There is simply no point in successfully following a No Touch trade strategy for a month to blow your profits on an impulsive Intraday gamble on the last day of the month!

2. Understand You Objectives and Yourself:

Understand your character and what will motivate your trading. Does your

temperament suit short term trading or long term positioning? Are you good at making rapid judgement calls? Do you like to take time to assess situations before jumping in? As we do in life, we all display different characteristics and we demonstrate these traits when we sit in front of the trading screen. Can you adhere to your trading plan and wait for an opportunity to present itself? The answer should be ‘yes’.

Be honest with yourself and try to form a style of trading that suits your character and purpose. Use your trading plan to help identify areas where you are potentially weak. Structure it to help support these areas when you are trading.

If, for example, you struggle to cut your losses when a trade is going against you, then maybe defining a specific exit point on your trading plan would be beneficial.

3.Risk Management:

Assess your risk management. Never chase returns or place too much emphasis on a particular trade outcome. A losing trade should be a disappointment but not the end of your trading career. Everyone wants a “get rich quick” scheme but the reality is that, wealth takes time to accumulate. Remember: slow incremental gains with good money management are the keys to success. Always think in terms of what you could lose, as opposed to how much you could gain.

4.Review Your Trading Strategy:

Has it come through this type of market before? Is it still generating signals? Is your system mechanical or do you make subjective calls? One key thing to remember is that all 'systems' will generate periods of under-performance. This is true of even the best systems used by top traders. At the end of the day any form of trading is a numbers game. The objective is to win more frequently than you lose. For some systems there may even be periods of not trading at all until the market criteria that made the system successful returns. For example, systems based solely on technical indicators, tend to fair less well during spells of heightened market volatility.

5.Money Management:

As with all trading you should only risk money that you can afford to lose. If placing a trade for £500 causes you to lose sleep at night, then the chances are, you should probably be trading smaller amounts. Similarly, if a particularly high return trade is keeping you glued to your screen 24 hours a day, then maybe you should place it for a lower return in the future.

A losing trade should give rise to disappointment, not devastation. Find a level of risk that you are comfortable with and develop a staking plan that will protect your capital following the inevitable losers.

6.Remain Mindful Of the Markets:

Markets often work in correlation with one another. Forex pairs often work in inverse relation to each other. For instance, the EUR/USD and the USD/CHF tend to be inversely correlated, so when the EUR/USD goes up, the USD/CHF goes down. A further example would be the AUD/USD pair, often referred to as the 'commodity currency,' because of the way in which the pair tracks the Gold price.

By accounting for this in your trading, you can avoid being overexposed to specific market outcomes. Markets can and will often correlate closely for long periods of time. Beware of placing too much risk across pairs which display similar reactions to market fundamentals.

7.Focus:

The trading world is a big place! With all the markets and opportunities available it can be overwhelming. Find a market (or markets) that you feel comfortable with and keep up with the news flow and what makes it move. You don't have to be rigid on this, but there will be times when particular markets are more attractive to trade, especially during periods of strong trends. Stick to the major indices and the big four currency pairs where news flow and analysis are readily available.

Only look across other markets as your experience, confidence and knowledge grow.

8. Adjust Your Trading:

If your trading system is working and your risk strategy is in place, start to look at yourself for further improvements. Psychology plays a huge role in trading. By understanding yourself, you will be able to further improve your trading. Common mistakes that can be made are trading too much after a loss or too little due to a lack of confidence.

Try to remove some of the emotion out of your trading, especially when you are trading larger sums. However, don’t jump in too quickly. Earn the right to trade larger amounts and learn to be self critical. Analyse the way you react when a trade is going against you. Do you hold until the bitter end or jump ship too early?

Note your responses on your trading plan and be aware of them when, in future, you find yourself in similar situations. If you have adjusted badly to the situation, try selecting only your premium ideas or lower your stake sizes to see if this affects your mental well-being. Rebuild your confidence. Confidence is good for your trading, over exuberance is not!

9. Enjoy Your Profits!

It is our view that any activity that you undertake in life should be rewarding.

Fixed odds trading is no different. Take some time out to enjoy the profits you make. Every now and then take out some of your profits. Even if you are trading smaller lots you can still treat yourself to the latest DVDs, some new clothes or maybe save the money elsewhere for something you have always wanted. If you are going to invest your time then you should be rewarded!

Binary Option Trading Type

Strategic Binary Trade Types:

These types of trade form the ‘core’ of all our fixed odds trading strategies including the ones detailed in this guide. The strategic trade types are as follows:

1. Rise/Fall

2. Higher/Lower

3. Touch/No Touch

4. In/Out

NOTE: Rise/Fall trades are no different to Higher/Lower trades (if you specify “than the current spot” as 0 (zero) when placing a Higher/Lower trade). Additionally, for Rise/Fall trades you can specify a timeframe less than 5 minutes, but we see no reason why anyone

would want to do this, as part of a well thought out trading strategy. So for Rise/Fall functionality see the Higher/Lower trade type definition

would want to do this, as part of a well thought out trading strategy. So for Rise/Fall functionality see the Higher/Lower trade type definition

Higher/Lower

Concept: This is a bet that an instrument will close above/below a specified price at the end of a specified period of time. “Higher” or “Lower” is specified when placing the trade. If the market price is above the specified price (for a “Higher” bet type) at the end of the specified period, the bet will be won. If it is below the specified price, then the bet will be lost. “Higher” bet type shown in example above. For a “Lower” bet type, the bet will be won if the market price is below the specified price at the end of the specified period. If it is above the specified price, then the bet will be lost. In both instances, it does not matter what the price does during the specified period. All that is important, is where the price is at the end of the specified period.

Concept: This is a bet that an instrument will close above/below a specified price at the end of a specified period of time. “Higher” or “Lower” is specified when placing the trade. If the market price is above the specified price (for a “Higher” bet type) at the end of the specified period, the bet will be won. If it is below the specified price, then the bet will be lost. “Higher” bet type shown in example above. For a “Lower” bet type, the bet will be won if the market price is below the specified price at the end of the specified period. If it is above the specified price, then the bet will be lost. In both instances, it does not matter what the price does during the specified period. All that is important, is where the price is at the end of the specified period.

Example: The USD/CAD has rallied strongly but you expect the price action to top out in the next few days. You use the “Lower” bet type with a price, of say 100 pips, below the current market price and a duration of 7 days. The market moves down. Provided it is lower than the specified level at the end of the specified period, you win.

Our View: The Higher/Lower bet type can be used when you feel strongly that the market is heading in a particular direction.

Touch/No Touch

Concept: This is a bet that an instrument will touch/not touch a specified price during a specified period of time. “Touch” or “No Touch” is specified when placing the trade. If the market price touches the specified price (for a “Touch” bet typ

e) during the specified period, the bet will be won. If it is does not touch the specified price then the bet will be lost. For a “No Touch” bet type, the bet will be won if the market price does not touch the specified price during the specified period. If it does touch the specified price, then the bet will be lost. “No Touch” bet type shown in example above.

Example: EUR/USD has reached record highs at 1.5000 and you expect its

gains to consolidate in the near term. At its all time high, you place a “No Touch” trade at 1.5200 within the next 5 days. Provided the EUR/USD consolidates, does not move higher and it does not touch this level before expiry, you win.

Our View: We particularly like the Touch and No Touch bet types as they allow us to predict general levels that the market may or may not touch. Depending on our trade setup and fundamental view, we can adjust the levels to our liking for the optimum return or move those levels to reduce our return for a greater safety barrier.

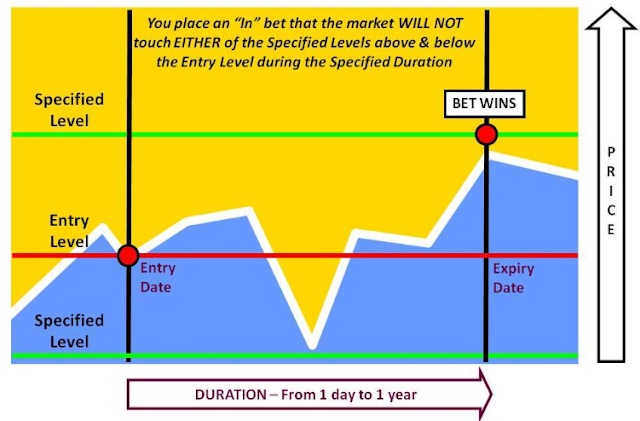

In/Out

Concept: This is a “boundary” bet, where two price levels (a high and a low) are specified. It is a bet that an instrument will either stay within a specific boundary or will breach the boundary. If during the specified period, the market price does not touch either of the specified prices (for an “In” bet type), the bet will be won. If it touches either of the specified prices, then the bet will be lost. For an “Out” bet type, the bet will be won if the market price touches both of the specified

prices during the specified period. If neither of the prices or just one of the prices is touched, then the bet will be lost.

Example: The EUR/GBP pair is at 0.8950 and has been trading in a range for the last two weeks. You expect this to continue in the near future and place an “In” trade, that it will not hit either 0.9150 or 0.8720 over the next 7 days.

Our View: The “In” bet type is ideal for trading during periods when the markets are quiet and/or in consolidation. The “Out” bet type could be used for periods of high volatility, but to date we have not found much practical use for it, preferring to choose a direction and use the “Touch” bet type instead.

Benefits of Binary Option Trading

1. Simple to Understand :

1. Simple to Understand :

Fixed Odds trades are easy to place and understand. With low minimum account opening values and the ability to start placing trades from just £10, Fixed Odds brings the potential to profit from financial markets to a much wider audience.

2. Limited Risks: Your risk (potential loss) is limited to your stake. You know both your potential profit and your liability prior to placing your trade! There is no chance of a ‘margin call’ and you cannot trade with money that you do not have in your account.

3. Sell Your Bet Back Early: You can sell your bet back before expiry. This is useful either if you want to bank profits early or if you want to sell out of a trade that is going against you. You sell back the bet to BetOnMarkets for its current market value and you can then use this for your next opportunity!

4. Trade a Range Of Markets from One Account: Fixed Odds offer convenience with the ability to trade an ever increasing number of markets from just one account. At present you can trade Stock Indices, Currencies Oil, Gold and increasingly individual shares and commodities.

5. Multiple Trade Types to Take Advantage of Different Market Conditions: With Fixed Odds you are not limited to simply ‘Up’ or ‘Down’ bets. This is because you select not only the market you wish to trade but also the way in which you believe the market will behave. You can profit not only from traditional long/short strategies but also from specific types of bet to take advantage of range bound and volatile markets. In fact, there is a bet type for almost every market condition!

6. Tax Free Profits: As fixed odds trading is technically classed as betting, all returns made are tax free! (UK) Apart from the spread there are no other hidden or additional charges. The price you are quoted for your bet is the price you pay. And of course your winnings are just that, your winnings!

Sunday, November 25, 2012

make money forex - Learn make money with forex trading

In this post I'll learn as earn money with forex trading.

The currency exchange is the largest market in the world, you can earn a lot of money, but this market is risky, dextrement

Find trading website:

To begin to find a good forex trading site.

There are lots of different commerce sites online that you can choose when buying and selling in the foreign exchange market. I you advice using etoro, this broker is one of the market-maker, if you be starting this broker is perfect to start a trader.

Etoro learn you the basics on forex trading and you can use their free demo trading platform for learning.

Etoro ensures up-to-date information in real time, because a few minutes delay you can listen lot of money during the negotiation of currencies.

Etoro is a legitimate site.

Invert:

Before investing a large amount in the foreign exchange market know is discouraged. This may seem like common sense, but it is very important that you have a mentor to help you or simply decide to research in books, make the right decision in the foreign exchange market comes from research. If you do well with small amount of money, and then try to invest still more in the foreign exchange market.

Forex trading software:

One of the excellent ways of money on the foreign exchange market is to find a good forex software, is to use extreme trading to earn more money.

Extreme trading is forex robot that guides you to make good decisions.

Monday, October 8, 2012

Advanced Candlesticks and Ichimoku Strategies for Forex Trading ebook

For the first time, our Forex analysts are revealing the strategies they use in formulating the trading ideas in our popular Candlesticks and Ichimoku Analysis section. These strategies are presented in our newly released ebook "Advanced Candlesticks and Ichimoku Strategies for Forex Trading." Don't miss this opportunity in learning these techniques that professional traders use. Step by Step guidance with images. Very Easy to learn.

Download both Part I and Part II NOW!

Subscribe to:

Comments (Atom)